Does Cigna Insurance Cover Drug & Alcohol Rehab in Los Angeles?

Last Updated August 20, 2025

Does Cigna Insurance Cover Drug & Alcohol Rehab in Los Angeles?

Yes, Cigna insurance typically covers drug and alcohol rehab, though the level of coverage depends on the specific plan and state. Most Cigna plans include substance use benefits as part of overall medical coverage, which can apply to both inpatient and outpatient rehab programs. Coverage often extends to case management, follow-up care, and support services such as recovery coaching or community referrals.

While Cigna generally provides access to a wide range of addiction treatment options, many services require prior authorization before starting care. This process ensures that treatment is medically necessary and aligns with plan rules. Members should review their plan documents to understand deductibles, copays, and coinsurance responsibilities, as these costs vary by policy. In most cases, choosing an in-network facility will significantly reduce out-of-pocket expenses. Connecting with Cigna’s member services or speaking with a doctor is often the best way to confirm eligibility and navigate the steps for getting treatment approved.

Check Your Cigna Insurance Coverage for Rehab Treatment

Common Insurance Terms to Know

-

Premium: The amount you pay each month to keep your health insurance active.

-

Deductible: The amount you must pay out of pocket each year before your insurance starts covering services.

-

Copay: A fixed dollar amount you pay for certain services, such as a doctor visit or prescription.

-

Coinsurance: The percentage of costs you pay for a covered service after meeting your deductible.

-

Out-of-Pocket Maximum: The most you will pay in a year for covered services. Once you reach this amount, insurance covers 100 percent of costs for the rest of the year.

-

In-Network: Providers, hospitals, or facilities that have a contract with your insurance company to offer discounted rates.

-

Out-of-Network: Providers or facilities without a contract. Care here usually costs more and may not be covered fully.

-

Prior Authorization: Approval you must get from your insurance before receiving certain treatments, procedures, or medications.

What Addiction Treatments & Services Does Cigna Cover?

-

Inpatient Rehab: Residential treatment with 24-hour medical and therapeutic support.

-

Outpatient Rehab: Scheduled therapy and counseling sessions while living at home.

-

Intensive Outpatient Programs (IOP): Structured treatment with multiple sessions per week, offering more support than standard outpatient care.

-

Partial Hospitalization Programs (PHP): Day treatment programs that provide intensive care without requiring overnight stays.

-

Detox Services: Medically supervised withdrawal management to ensure safety and comfort during detoxification.

-

Medication-Assisted Treatment (MAT): Use of medications such as buprenorphine, methadone, or naltrexone alongside therapy.

-

Therapy & Counseling: Individual therapy, group counseling, and family therapy for addiction and co-occurring conditions.

-

Dual Diagnosis Treatment: Integrated care for people with both a substance use disorder and a mental health condition.

-

Case Management & Aftercare: Support services that help coordinate care and prevent relapse after treatment.

-

Peer & Recovery Support: Access to recovery coaches, peer groups, and digital tools to support long-term recovery.

What Addictions Will Cigna Cover?

Cigna provides coverage for a wide range of substance use disorders, encompassing both legal and illicit substances. This includes, but is not limited to:

-

Alcohol: Excessive consumption leading to alcohol use disorder.

-

Prescription Medications: Misuse of opioids, benzodiazepines, stimulants, and other prescribed drugs.

-

Illicit Drugs: Use of substances such as cocaine, heroin, methamphetamine, and hallucinogens.

-

Over-the-Counter Medications: Abuse of non-prescription drugs like cough syrups or cold medications.

-

Cannabis: Use of marijuana, which can lead to cannabis use disorder.

Cigna’s coverage for addiction treatment is subject to the specifics of your health plan, including the level of coverage and the medical necessity of the treatment.

Does Cigna Cover Mental Health Disorder Treatment?

Yes, Cigna does cover mental health disorder treatment, including care for people who are struggling with both a substance use disorder and a mental health condition. This type of care is often referred to as dual diagnosis or co-occurring disorder treatment. Cigna recognizes that addiction and mental health issues often go hand in hand, so most plans include benefits for therapy, psychiatric care, and medications that support recovery.

Depending on the plan, services may include individual therapy, group counseling, family therapy, medication management, and behavioral health programs tailored to conditions like depression, anxiety, PTSD, or bipolar disorder that often occur alongside addiction. Prior authorization is usually required to confirm medical necessity, and members will often pay less if they choose an in-network provider or facility.

Does Cigna Cover Virtual & Telehealth Treatment?

Cigna generally covers virtual and telehealth services for addiction treatment and mental health care, though coverage can vary by plan. Telehealth allows members to attend therapy, counseling, and even some psychiatric appointments remotely via secure video or phone sessions. This can include individual therapy, group counseling, medication management, and follow-up support for both substance use disorders and co-occurring mental health conditions.

Using telehealth can make treatment more accessible, especially for members who live far from in-network rehab facilities or have difficulty attending in-person sessions. Many Cigna plans treat telehealth visits the same as in-person visits in terms of coverage, copays, and deductibles, provided the provider is in-network. Prior authorization may still be required for certain services, and some intensive programs like inpatient rehab cannot be delivered virtually. Members should confirm with Cigna which telehealth services are covered under their specific plan and whether their chosen provider participates in the network.

How to Use Cigna Insurance for Rehab Treatment

-

Step 1: Verify Coverage: Review your Cigna plan documents or member portal to see what addiction treatments are covered, including inpatient, outpatient, detox, dual diagnosis, and MAT.

-

Step 2: Find In-Network Providers: Use the Cigna Provider Directory to locate approved rehab centers and mental health specialists. Consider facilities recognized for quality care.

-

Step 3: Confirm Plan Requirements: Check if prior authorization or a referral from a primary care or behavioral health provider is needed.

-

Step 4: Gather Necessary Information: Collect your member ID, medical records, and any required forms for prior authorization.

-

Step 5: Contact Cigna: Call member services to verify coverage, costs, and approved providers, and ask about deductibles, copays, and coinsurance.

-

Step 6: Confirm Costs and Benefits: Understand your out-of-pocket expenses and which services are covered under your plan.

-

Step 7: Schedule Treatment: Arrange admission with the rehab center once coverage and authorizations are confirmed, ensuring all paperwork is submitted.

-

Step 8: Continue Care After Rehab: Use your plan for outpatient therapy, follow-up counseling, relapse prevention programs, or telehealth support.

What to Do if Cigna Denies Coverage

If Cigna denies coverage for rehab or addiction treatment, there are several steps you can take to challenge the decision and potentially get the care approved.

First, review the denial letter carefully to understand the specific reason for the denial, such as lack of medical necessity, out-of-network provider, or incomplete documentation. Gather any supporting medical records, assessments, or doctor recommendations that demonstrate the need for treatment.

Next, file an internal appeal with Cigna. This involves submitting a formal request for reconsideration, along with supporting documentation. You can usually do this through the myCigna portal or by mailing the appeal to the address provided in the denial letter. Keep copies of everything you submit.

If the internal appeal is denied, you have the option to request an external review. This is a process where an independent third-party reviews the denial to determine if coverage should be granted. Some states require insurance companies to offer this option.

Throughout the process, it can help to work with your rehab provider or a patient advocate, as they can supply clinical justification and help navigate the paperwork. Also, make sure to adhere to all deadlines, since appeals often have strict time limits.

About Cigna Insurance: Statistics & History

Cigna was formed in 1982 through the merger of two longstanding insurance companies: the Insurance Company of North America (INA), founded in 1792 in Philadelphia as the first stock insurance company in the United States, and the Connecticut General Life Insurance Company (CG), founded in 1865 in Hartford, Connecticut. The merger combined their strengths in life and health insurance, creating a company with a broad national presence. Over the years, Cigna has continued to evolve, expanding its services to include comprehensive behavioral health and addiction treatment through initiatives such as the Evernorth Behavioral Care Group. The company has also focused on community programs supporting youth, veterans, and health equity, reflecting its commitment to integrating mental health and wellness into overall care. Today, Cigna is recognized as a major health insurance provider in the U.S., offering a range of medical, behavioral health, and rehabilitation services to millions of members nationwide.

As of 2023, The Cigna Group serves over 178 million customer relationships across more than 30 countries and jurisdictions. In the United States, Cigna Healthcare provides medical coverage to approximately 19.8 million customers, while its pharmacy benefits management division, Evernorth, serves about 98.6 million customers. Additionally, Cigna’s Medicare business, which was sold to Health Care Service Corp. in early 2024, had 3.6 million customers, including those with Medicare Advantage, Part D prescription drug coverage, and Medicare Supplement plans.

Cigna Plans & Tiers

Cigna’s individual and family health insurance plans are categorized into four metal tiers, each representing a different level of coverage and cost-sharing:

-

Bronze: Covers approximately 60% of healthcare costs; lower monthly premiums but higher out-of-pocket expenses.

-

Silver: Covers about 70% of healthcare costs; balanced monthly premiums and out-of-pocket expenses.

-

Gold: Covers roughly 80% of healthcare costs; higher monthly premiums but lower out-of-pocket expenses.

-

Platinum: Covers approximately 90% of healthcare costs; highest monthly premiums with the lowest out-of-pocket expenses.

Cigna provides several types of health insurance plans, each offering different levels of flexibility and provider access:

-

Health Maintenance Organization (HMO): Requires members to choose a primary care physician (PCP) and obtain referrals to see specialists.

-

Exclusive Provider Organization (EPO): Offers a network of providers; no referrals needed for specialists, but out-of-network care is not covered except in emergencies.

-

Point of Service (POS): Combines features of HMO and PPO plans; requires a PCP but allows out-of-network care at a higher cost.

-

Preferred Provider Organization (PPO): Provides the most flexibility; members can see any healthcare provider without a referral, though in-network care is more cost-effective.

Insurance companies like Cigna typically base these criteria on widely accepted clinical standards such as the American Society of Addiction Medicine (ASAM) Criteria, which evaluate the patient’s physical, psychological, and social needs. Meeting medical necessity criteria is often required for prior authorization, which is the insurance company’s approval before covering a specific service. Without demonstrating medical necessity, certain services, especially higher levels of care like residential rehab, may not be approved or may result in higher out-of-pocket costs.

Rehabs That Take Cigna Insurance for Drug and Alcohol Addiction Rehab

In addressing addiction and substance use disorders, individuals on the path to recovery often seek assistance from specialized addiction treatment centers. For those covered by Cigna, a pivotal step in their journey toward recovery and sobriety involves finding rehab centers that take Cigna insurance.

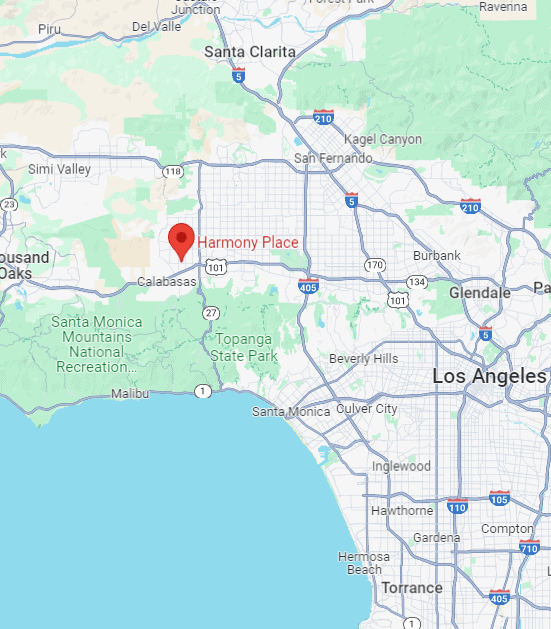

Cigna drug rehab centers and Cigna alcohol rehab centers play crucial roles in the treatment and recovery process. At Harmony Place, we provide holistic and compassionate care for adults confronting mental health and substance use disorders, accepting a variety of health insurance policies, including Cigna, to facilitate your access to recovery support and streamline the rehab admissions process.

Have questions such as, “Does Cigna insurance cover alcohol rehab?” or “Is there a drug rehab that accepts Cigna near me?” Call Harmony Place today at (855) 652-9048. One of our trained professionals will be happy to assist you in answering any questions you may have.

What is the Average Cost of Substance Addiction Rehab in Los Angeles, CA With Cigna Insurance Coverage?

The average cost of addiction rehab in Los Angeles, CA, with Cigna Insurance, varies depending on the specific treatment program and its duration. Cigna usually covers a significant portion of the expenses associated with addiction rehabilitation services, making it more affordable for individuals seeking recovery.

To get precise details about coverage and estimated costs, you can contact Cigna directly or let the rehab team at Harmony Place help you determine the cost of addiction rehab under your specific Cigna plan.

How To Check Cigna Insurance Coverage for Rehab Treatment in Los Angeles

To determine Cigna coverage levels for rehab treatment in Los Angeles, individuals can take several steps. Firstly, contacting the Cigna customer service hotline, usually found on the back of the insurance card, allows for a direct inquiry about coverage specifics related to rehab services.

Alternatively, visiting the official Cigna website and logging into the member portal provides access to personalized information regarding coverage details, including those related to addiction treatment. Additionally, rehab facilities such as Harmony Place have dedicated insurance verification teams that can assist in verifying your Cigna coverage. By providing them with necessary details, such as policy information, individuals can receive clarity on the extent of their insurance coverage for rehab treatment in Los Angeles.

How To Get Cigna To Pay For Rehab Treatment in Southern California

So, does Cigna insurance cover drug rehab and how do I get it covered? Securing coverage for Cigna drug rehab and Cigna alcohol rehab treatment in Southern California involves a systematic approach to navigate the claims process effectively. Initially, you should reach out to Cigna directly to comprehend the specific terms and conditions of your insurance plan.

Alternatively, you can contact us at Harmony Place for assistance in navigating the rehab insurance process. Additionally, to ensure Cigna covers the costs of rehab treatment in Southern California, it is essential to compile all necessary documentation and information related to the recommended rehab. This may encompass medical assessments, treatment plans, and other pertinent details that substantiate the medical necessity of the proposed rehab services. By providing comprehensive and well-documented information, individuals can bolster their case for Cigna coverage. For assistance with this process or to ask questions regarding how to pay for addiction treatment, you can contact us online or call Harmony Place at (855) 652-9048.

How Many Times Will Cigna of California Pay For Rehab in Los Angeles?

The number of times Cigna of California will pay for rehab in Los Angeles depends on many factors, including the specific insurance plan, the type of rehab services needed, and the terms outlined in the insurance policy. Cigna typically provides coverage for many rounds of rehab when it is considered medically necessary.

The assessment of medical necessity typically relies on factors such as the gravity of the substance use disorder, the efficacy of past treatments, and the advice provided by healthcare professionals. If you are a patients covered by Cigna for addiction treatment who is considering rehab treatment programs, contact us at Harmony Place for help.

Request a 100% Confidential Callback

Cigna Drug Rehab Coverage: Seeking Help from Harmony Place

At Harmony Place, we offer patients a safe and comfortable environment to heal and pursue long-term recovery. Individualized care at a variety of treatment levels to ensure you or your loved one is getting the help you need.

In addition to professional care, Harmony Place is committed to working with a wide range of insurance companies, including Cigna. Rehab in Los Angeles at Harmony Place with your Cigna insurance can help to reduce the overall cost of treatment. For more information about our facility or if you have questions such as, does Cigna cover alcohol rehab? Contact us today.